The community devoted to the jobs and the Companies in the world of innovation.

Sign upOr use your linkedin profile

Sign inExplore 12 Companies at the forefront of the future of innovation in Europe. Discover their offices, get to know their history and the values that inspire them on a daily basis. Apply to join their teams and become one of their leading lights.

Meritocracy personally engages with Companies to give voice to the real people behind them. Listen directly to Managers, CEOs and Founders what are their most exciting challenges, what drives them to innovate products and processes and why you should join their team.

Concerned about your work-life balance? Discover the benefits that companies offer to their employees. Relax with a yoga class or a get stuck into a book from the company library. Or perhaps go to the theatre with colleagues after work or challenge them to a game of table football.

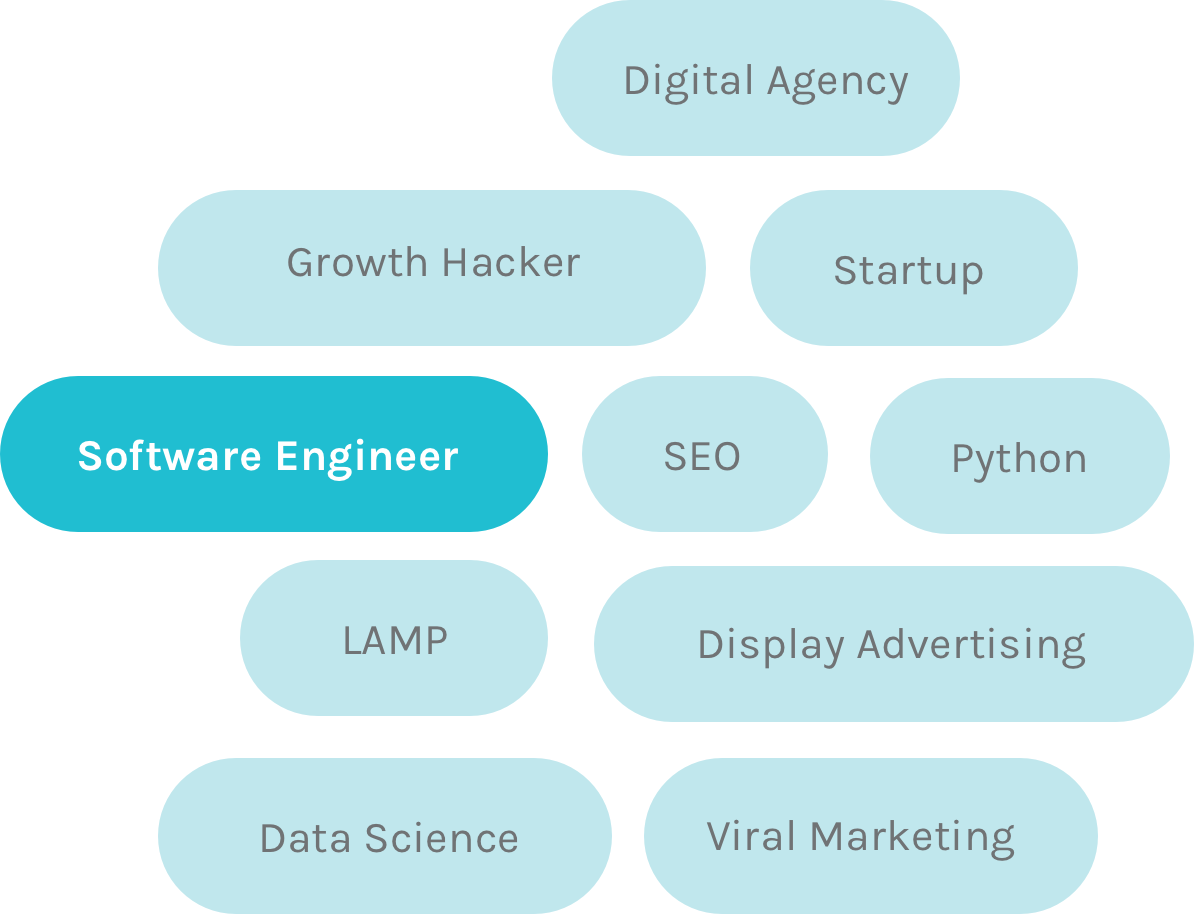

Digital technology is key to innovation: what technologies are companies using? Meritocracy can answer these questions, highlighting the most useful tools and utilities, the most common types of database and the programming languages you will need to join your chosen company.

To innovate, you need to stay up-to-date: Meritocracy gives you access to articles to increase your knowledge of technology and innovation. Perfect for enthusiasts, nerds, geeks, and anyone who wants to stay up-to-date with tomorrow's world.